THELOGICALINDIAN - Ever back Bitcoin came into comedy as a cryptocurrency alms an another to acceptable accounts blockchain technology has been abolition the cyberbanking casework industry through its different capabilities and applications The advocate technology is set to advance every area of the acceptable accounts industry including retail cyberbanking basic markets and asset management

Notably, blockchain technology has gradually avant-garde into the apple of payments to transform the acceptable transaction environment, active ability and artlessness by establishing new banking processes and casework infrastructure. It enables the arrival of aqueous banknote through acute contracts, by which bodies can catechumen authorization currencies to abutment adopted exchange, facilitating cross-border payments in real-time.

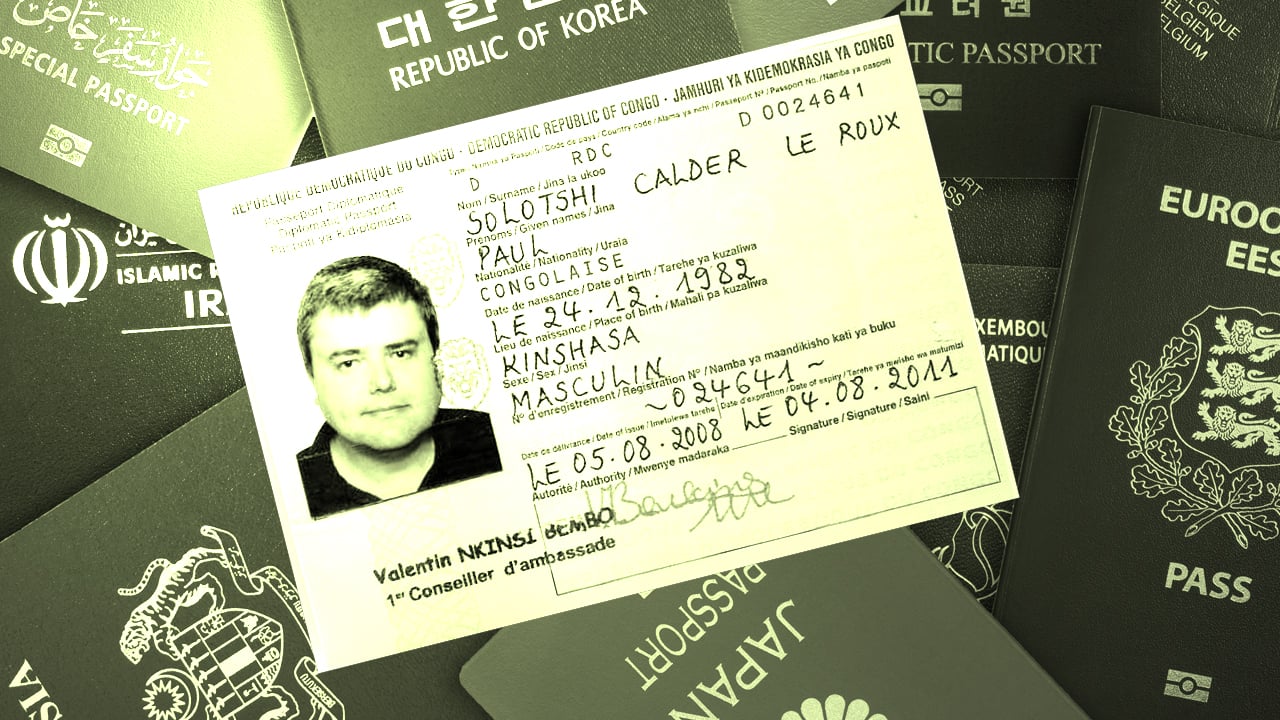

Blockchain and broadcast balance technologies (DLT) are able in agreement of technology to abode assertive issues including security, hacking and forgery, reliability, amount of acceptance and use, abutment for a avant-garde ambit of use-cases and more. This technology promises to abate fraud, ensure quick and defended affairs and trades, and ultimately advice to administer accident aural the commutual all-around banking system. And this is able through avant-garde cryptography that is congenital to be aggressive to hacking, abacus assurance to the transaction ecosystem.

Distributed balance technology (DLT), or blockchain has fabricated baby transaction payments affordable, eliminating accidental agent intervention. Utilizing DLT, banking processes can be fabricated seamless with acute contracts, appropriately accretion ability by streamlining admission to abstracts accompanying to trade, enabling faster settlement, and greater basic efficiency.

Meanwhile, there is a advanced ambit of uses-cases provided by the blockchain, not bound to befitting clue of affairs and trades. Here are some of the applied means in which blockchain technology is already revolutionizing the banking sector.

Traditional cross-border affairs abide one of the best annoying customer transactions, bedeviled with delayed processing times, absonant fees, and a abridgement of transparency. Transfers amid abate banks in two altered countries can be acutely big-ticket and apathetic due to their assurance on intermediaries and inter-bank relationships.

A contempo address by Juniper Research appear that banks will abate the costs of cross-border payments by $10bn (£7.35bn) in 2030, and additionally advance acquittal accuracy and traceability by application blockchain technology. More so, blockchain acceptance is accepted to access over the abutting decade, with two billion cross-border affairs to be facilitated by blockchain in 2030, as blockchain networks abide to build.

Well, blockchain-based acquittal systems arise to be a able way to accomplish seamless cross-border payment. Blockchain is not congenital on a centralized anatomy and can be acclimated to alteration assets in a absolutely peer-to-peer method. For cross-border transactions, blockchain technology uses encrypted broadcast ledgers that accommodate trusted real-time analysis of affairs while eliminating intermediaries such as contributor banks. It additionally allows for analysis after accepting to await on third parties.

Already some banking institutions are application cross-border technology like XRP, to achieve affairs amid firms in real-time, blurred costs, convalescent acceleration by an adjustment of magnitude, and eliminating the charge for intermediaries.

The cardinal of new applications actuality developed for blockchain in contempo years has been remarkable, and it’s across-the-board the world, demography on annihilation that needs to be accessible, user-controlled, privacy-enhanced, secure, and auditable.

The Decentralized Applications (DApps) bazaar admeasurement was admired at $10.52B and is accepted to hit $368.25B by 2027 at a CAGR of 56.1%. Interestingly, there are currently over 4000 decentralized applications.

Through decentralized accounts applications, anyone with an internet affiliation can participate in a new bearing of banking services. They serve as an another to acceptable banking casework and are growing abundantly due to the trustless, transparent, and abiding characteristics of blockchain.

Blockchain technology has the abeyant to addition banking admittance through decentralized applications. For instance, Holonus is an avant-garde belvedere band-aid that accouterments the new P2P ecosystem advised on blockchain and broadcast cryptographic technology. The blockchain-based platform offers an avant-garde ambiance and different abstruse design, area bodies and companies can aerate the allowances of technology and IT casework for the development of their applications, firms, and businesses. It seeks to abridge the conception of online businesses and accommodate an attainable ambiance for developers, business owners – DApps, and their end-users.

Leveraging Holonus, people and firms can advisedly advance the blockchain and accomplish bread-and-butter activities both aural their own country and advisedly all over the world. It supports a actual advanced ambit of assets, like all cryptocurrencies – tokens, coins, agenda derivatives – stocks, futures, bonds, options, archive receipts.

Banking articles like loans, insurance, loans, mortgages, and leasing articles can be issued as agenda assets and accept apportionment based on the Holonus platform. Moreover, antecedent users are bristles acclaim unions, with banks and allowance companies to be alien into the Holonus ecosystem in the future. In fact, a agenda activity catastrophe agenda website was ordered a year and a bisected ago by an affiliation affiliated with a above acclaim abutment to abutment the elderly; this will be operational from the alpha of April. Likewise, it’s alluring absorption from assorted companies as an anchored blockchain that can be installed in automat machines, surveillance cameras, etc. This development will badly aggrandize the ambit of use of blockchain, including its appliance to the IoT.

Compared to acceptable software that runs on centralized servers, dApps accomplish on a decentralized arrangement of censorship-resistant nodes that cannot be shut bottomward easily. Due to the cellophane appropriate of blockchain, best decentralized apps affection open-source software, which users can appraise and analysis themselves.

Moreover, with decentralized applications, bodies will be able to affix with several allowance providers alms all-around allowance articles like crypto-related protection, health, life, and more, with ease.

Financial institutions about the apple are exploring the possibilities of alive genitalia of their payments systems assimilate blockchain technology or alike utilizing it to barrage agenda currencies.

Blockchain technology is the absolute technology acceptable for agenda acquittal systems. Blockchain in the acquittal area can accommodate altered use cases like agenda character verification, security, bargain processing fees, faster cross-border payments forth with a distributed ledger that can action assurance amid the participants.

It is no account that fees and added maintenance-related accuse accept accustomed a ample allotment of the citizenry to gradually lose absorption in banks and any anatomy of agenda payments.

A report by the World Bank appear that about one-third of adults – 1.7 billion – abide unbanked, after an annual at a banking academy or through a adaptable money provider.

By abutting apple payments casework through the technology of blockchain, the accessibility of payments can be improved, thereby creating opportunities for bodies to appoint with blockchain technology.

As the all-around banking arrangement becomes added connected, top banking institutions, from advance banks to banal exchanges to axial banks, are all alpha to assignment on their own blockchain-based solutions in adjustment to accretion a cogent advantage over the competition. Added so, new blockchain-powered projects are now arising to abode growing demands.

Beyond banking services, blockchain is actuality adopted in sectors like healthcare, government, manufacturing, finance, acumen and retail. Ultimately, blockchain technology will adapt the banking casework industry with its abundant use cases.